Achieving a 100% Permanent and Total (P&T) rating is a significant milestone in a veteran’s post-service life. It signifies that the VA recognizes your service-connected disabilities are totally disabling and unlikely to improve. This status unlocks a suite of enhanced federal and state benefits that go far beyond standard monthly compensation.

What does “Permanent and Total” mean?

- Total: You are rated at 100% (or paid at the 100% rate via TDIU).

- Permanent: The medical evidence shows your condition is “static” and reasonably certain to continue throughout your life.

Note: P&T status generally protects you from future routine re-examinations.

At a Glance: The Top 7 Benefits for P&T Veterans

Whether you are rated 100% schedular or 100% via TDIU, P&T status grants you and your family access to these life-changing programs:

- 1. Healthcare & Prescriptions: No-cost care and medication copay reimbursement.

- 2. Education (DEA): Monthly stipends for your spouse and children to attend college.

- 3. Family Insurance (CHAMPVA): Comprehensive health coverage for dependents.

- 4. Dental Care: Complete dental coverage for the veteran.

- 5. Base Access (USID): Access to commissaries, exchanges, and MWR facilities.

- 6. State Perks: Free hunting/fishing licenses and property tax exemptions.

- 7. Property Tax Breaks: Potential exemption from property taxes on your primary residence.

1. No-Cost Healthcare and Prescription Medications

As a 100% P&T veteran, you are placed in Priority Group 1 for VA health care. This means:

- No Copays: You are exempt from copayments for all medical care and prescription medications, even for conditions that are not service-connected.

- Urgent Care: You have broader access to community urgent care providers.

You can verify your specific eligibility using the Health Benefits Explorer tool or by calling 877-222-VETS (8387).

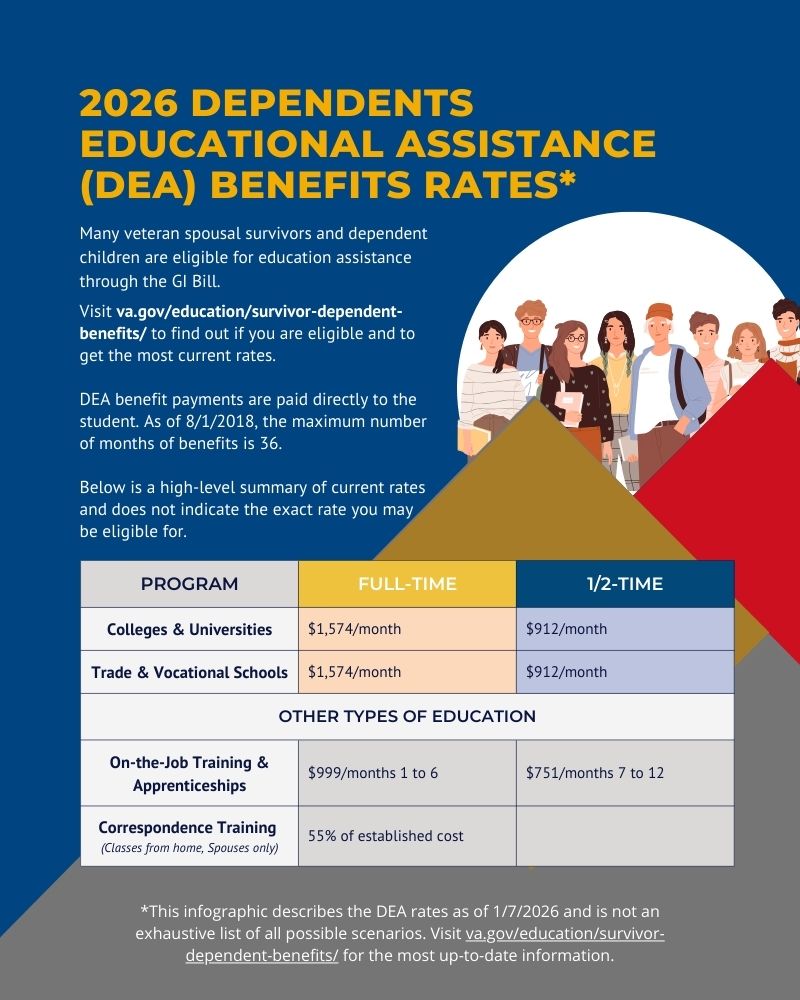

2. Dependents Educational Assistance (DEA / Chapter 35)

This is often considered the most valuable benefit for families. If you are P&T, your spouse and children are eligible for monthly education stipends.

- What it covers: College degree programs, vocational training, apprenticeships, and on-the-job training.

- The Amount: As of recent rates, the VA pays a full-time student approximately $1,400+ per month directly (rates change annually).

- Eligibility: Children are generally eligible between ages 18 and 26. Spouses usually have 10 years from the date of your P&T rating to use the benefit.

3. CHAMPVA Health Insurance

While you receive care at the VA, the Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) acts as health insurance for your spouse and dependent children.

- Coverage: It covers most medically necessary services, including inpatient/outpatient care and prescriptions.

- Providers: Dependents can see private civilian doctors who accept CHAMPVA.

- Cost: There are typically no premiums, though there may be a small annual deductible and 25% cost-share for covered services.

Contact the VA Health Administration Center at (800) 733-8387.

4. Complete VA Dental Coverage

Dental care is one of the hardest VA benefits to qualify for, but 100% P&T status unlocks Class IV Dental Benefits. This entitles you to comprehensive dental care at VA clinics for any dental issue, service-connected or not.

To start receiving care, simply contact the enrollment office at your local VA medical center.

5. Uniformed Services ID (USID) Card

You and your eligible dependents can receive a Department of Defense USID card. This card grants you privileges previously reserved for retirees, including:

- Commissary & Exchange: Tax-free shopping on military bases.

- MWR Access: Use of Morale, Welfare, and Recreation facilities like gyms, golf courses, campgrounds, and movie theaters.

- Space-A Travel: Eligibility to fly on military aircraft when surplus seats are available (Category 6).

6. State-Specific Benefits (Hunting, Fishing, & Vehicles)

Many states offer “thank you” perks specifically for 100% disabled veterans. While these vary by location, common benefits include:

- Free Licenses: Waived fees for hunting and fishing licenses.

- Vehicle Registration: Free or discounted vehicle registration and special license plates.

- State Parks: Free admission to state parks and campgrounds.

7. Property Tax Exemptions

This can save you thousands of dollars annually. Many states offer a full or partial waiver of property taxes for the primary residence of a 100% P&T veteran.

How to claim it: Typically, you must take your VA Benefit Summary Letter (downloadable from VA.gov) to your local county tax assessor’s office.